The number of deep-sea port calls in the Red Sea fell dramatically by 85 per cent on average in 2024, found Sea-Intelligence.

The firm’s latest analysis examined how the Red Sea had a significant impact on the container shipping industry.

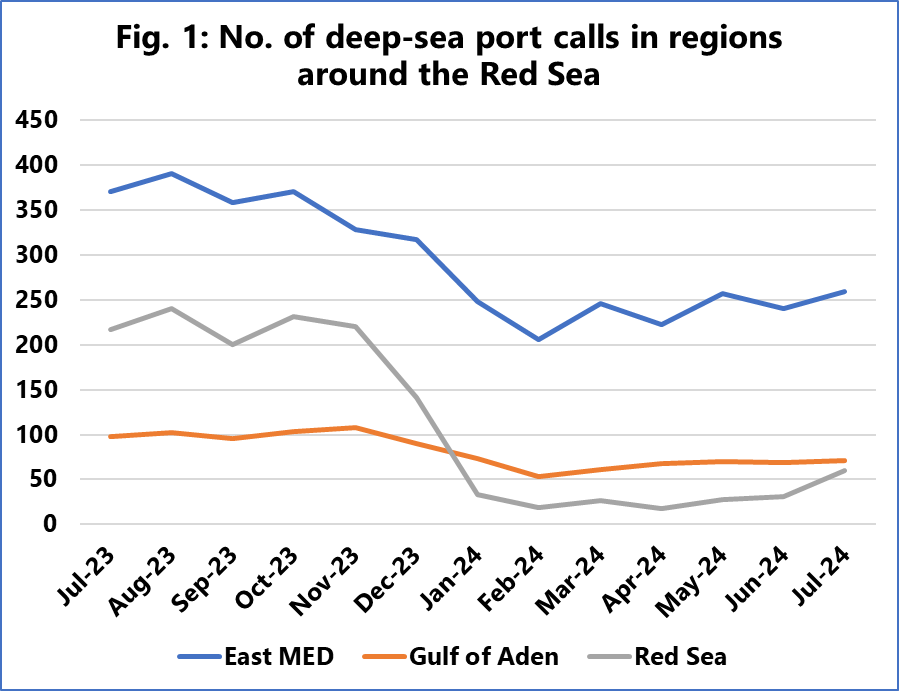

Figure 1 depicts the number of deep-sea port calls in the key locations nearest to the Suez Canal: the East Mediterranean (East MED), the Gulf of Aden, and the Red Sea itself.

While the overall number of monthly deep-sea port calls in East MED was already declining before to the crisis, the month-on-month (MoM) reduction in January 2024 was particularly severe, at 22 per cent.

In comparison to the pre-crisis average, the decline in 2024 is 33 per cent, noted Sea-Intelligence.

A comparable 33 per cent decline in average monthly calls was seen in the Gulf of Aden, from about 100 to 60-70 in 2024. Port calls in the region have begun to improve, albeit slowly, similar to East MED.

According to Sea-Intelligence, the figure fell from more than 200 calls per month to less than 40 between January and June 2024.

In July 2024, the number of calls increased to 60, more than double from prior months.

The Red Sea’s most affected ports were Jeddah and King Abdullah Port. Carriers stopped calling King Abdullah Port on deep-sea services in January 2024, while Jeddah saw the highest MoM fall of 74 per cent from December 2023 to January 2024.

Even with a minor rebound in July 2024, the port averages only 37 calls per month, compared to a pre-crisis average of 135 monthly calls.

READ: The multifaceted impact of the Red Sea crisis

In East MED, Piraeus and Port Said were the most affected, while in the Gulf of Aden, Salalah witnessed deep-sea port calls decline by about 50 per cent in January – February 2024, found Sea-Intelligence.

In terms of schedule reliability, the Danish firm noted that the Red Sea and East Mediterranean have returned to pre-crisis levels, while the Gulf of Aden is still underperforming.

Furthermore, the average delay of late vessel arrivals improved throughout all three zones, dropping from 10-14 days in January 2024 to 4-5 days before the crisis.